The remainder of the OPEC+ oil producers agreed to increase earlier cuts in provide by way of the tip of 2024.

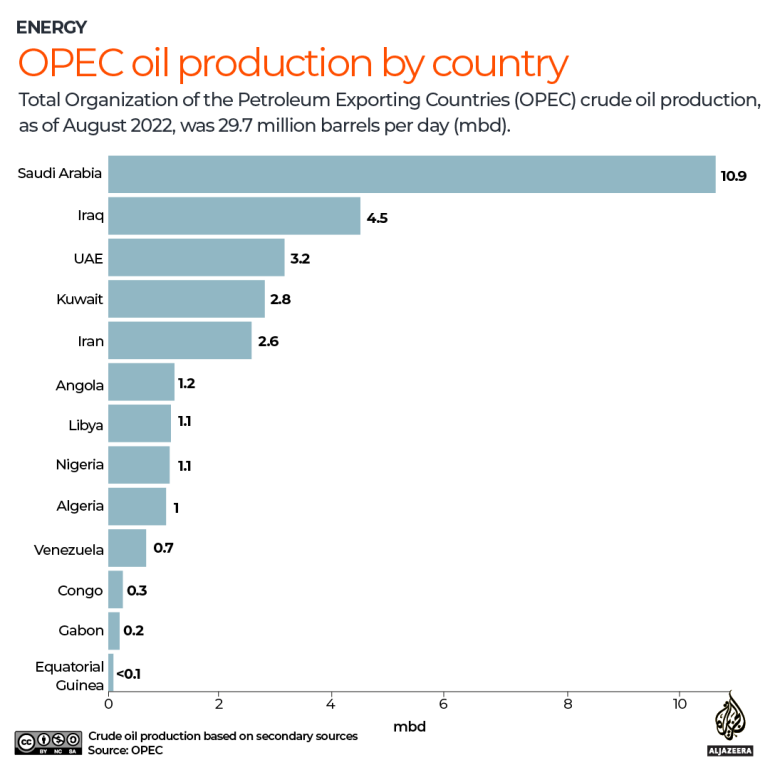

Saudi Arabia has stated it’ll cut back how a lot oil it sends to the worldwide financial system by a million barrels per day (bpd), because the OPEC+ alliance of main oil-producing international locations faces flagging oil costs and a looming provide glut.

The dominion stated on Sunday that it might make these manufacturing cuts in July to help the sagging value of crude after two earlier manufacturing cuts by OPEC+ members did not push costs increased.

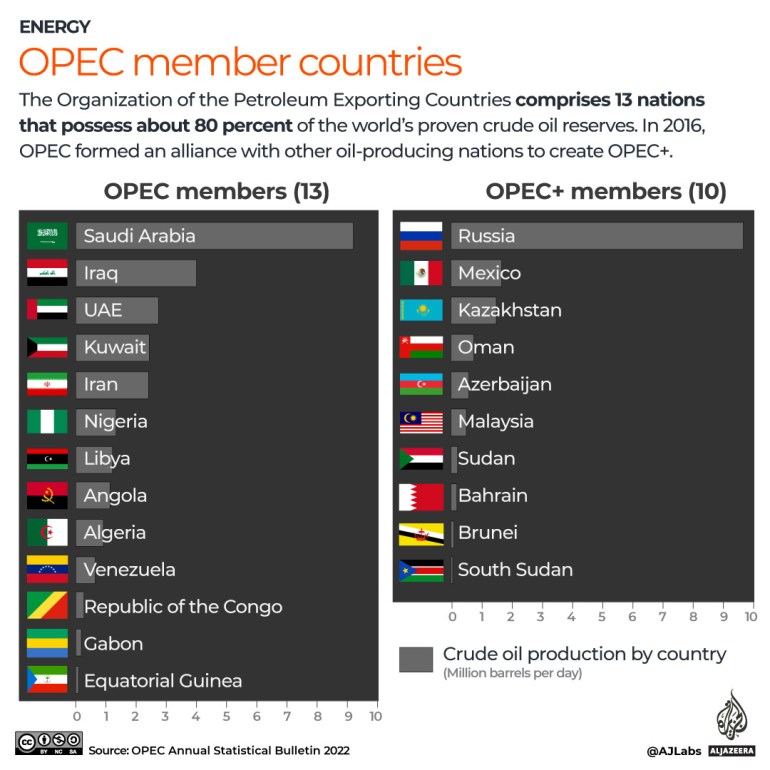

OPEC+, which teams the Group of the Petroleum Exporting International locations and allies led by Russia, reached a deal on output coverage after seven hours of talks at its headquarters in Vienna and agreed to increase earlier cuts in provide by way of the tip of 2024 by an additional whole of 1.4 million barrels per day.

“This can be a grand day for us, as a result of the standard of the settlement is unprecedented,” Saudi Vitality Minister Abdulaziz bin Salman stated in a information convention, including that the brand new set of manufacturing targets is “way more clear and way more honest”.

He additionally stated that the minimize by Riyadh could possibly be prolonged past July if wanted.

Nevertheless, many of those reductions won’t be actual because the group lowered the targets for Russia, Nigeria and Angola to deliver them into line with their precise present manufacturing ranges.

In distinction, the United Arab Emirates was allowed to lift output.

OPEC+ pumps round 40 % of the world’s crude, that means its coverage choices can have a significant influence on oil costs.

It already has in place a minimize of two million bpd agreed to final yr and amounting to 2 % of worldwide demand.

In April, it agreed to a shock voluntary minimize of 1.6 million bpd that took impact in Could till the tip of 2023.

Nevertheless, these cuts gave little lasting increase to grease costs.

Worldwide benchmark Brent crude climbed as excessive as $87 per barrel however has given up its post-cut positive aspects and has been lingering under $75 per barrel in latest days. United States crude has dipped under $70.

The stoop in oil costs has helped US drivers fill their tanks extra cheaply and given customers worldwide some reduction from inflation.

Falling power costs additionally helped inflation within the 20 European international locations that use the euro drop to the bottom stage since earlier than Russia’s invasion of Ukraine.

That the Saudis felt one other minimize was mandatory underlines the unsure outlook for demand for gas within the months forward.

There are issues about financial weak point within the US and Europe, whereas China’s rebound from COVID-19 restrictions has been much less strong than many had hoped.

Western nations have accused OPEC of manipulating oil costs and undermining the worldwide financial system by way of excessive power prices. The West has additionally accused OPEC of siding with Russia regardless of Western sanctions over Moscow’s invasion of Ukraine.

In response, OPEC insiders have stated the West’s money-printing over the past decade has pushed inflation and compelled oil-producing nations to behave to keep up the worth of their fundamental export.

Asian international locations, comparable to China and India, have purchased the best share of Russian oil exports and refused to hitch Western sanctions towards Russia.

Unsure consequence

It’s attainable the most recent manufacturing minimize may ship oil costs up and with them, petrol costs. However there’s uncertainty about when the slow-growing world financial system will regain its thirst for gas for journey and trade.

Saudis want sustained excessive oil income to fund bold growth initiatives geared toward diversifying the nation’s financial system away from oil.

The Worldwide Financial Fund estimates the dominion wants $80.90 per barrel to satisfy its envisioned spending commitments, which embody a deliberate $500bn futuristic desert metropolis venture referred to as Neom.

Whereas oil producers want income to fund their state budgets, in addition they must take note of the influence of upper costs on oil-consuming international locations.

Oil costs that go too excessive can gas inflation, sapping client buying energy and pushing central banks such because the US Federal Reserve in direction of additional rate of interest hikes.

Increased charges goal inflation however can gradual financial development by making credit score more durable to get for purchases or enterprise investments.